Asia markets trade mixed after U.S. government shuts down

Key Points

- The Reserve Bank of India expectedly held rates at 5.5%.

- The Bank of Japan released the Tankan index, which measures business sentiment among Japanese companies and is closely watched by the central bank.

- Markets on mainland China and Hong Kong were closed today for a holiday.

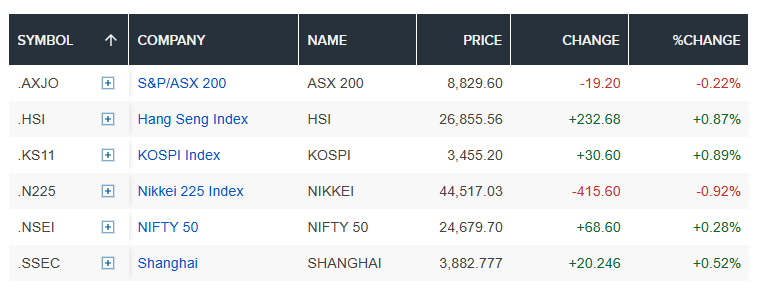

Asia-Pacific markets were mixed Wednesday, following gains on Wall Street as investors appeared unperturbed by the U.S. government shutdown.

Spot gold prices surged 0.09% to hit a fresh record of $3,875.32 as of 11:04 a.m. Singapore time (11:04 p.m. ET).

Over in Japan, the central bank released the results for its third-quarter Tankan survey. The Tankan survey measures business sentiment among domestic companies, and is closely watched by the Bank of Japan.

The index for business optimism among large Japanese manufacturers increased to +14 for the third quarter from +13 in the previous quarter, but was lower than the +15 expected by economists polled by Reuters. The non-manufacturing index held steady at +34.

A positive figure on the Tankan indicates that optimists outnumber pessimists.

The Reserve Bank of India held rates at 5.5%, in line with expectations by economists polled by Reuters. The Nifty 50 rose 0.31%, while the Sensex index added 0.22%.

In South Korea, the blue-chip Kospi was up 0.79%, and the small-cap Kosdaq gained 0.56%.

The Taiwan Weighted Index led gains in Asia, adding 1.14% as healthcare and tech stocks powered the index's rise. Chip heavyweight TSMC was up 2.3% after AI darling Nvidia topped $4.5 trillion in market cap.

Australia's S&P/ASX 200 slipped 0.26%.

Markets on mainland China and Hong Kong were closed for a holiday.

Overnight in the U.S., the S&P 500 closed up 0.41% at 6,688.46, while the Nasdaq Composite climbed 0.31% to finish at 22,660.01.

The Dow Jones Industrial Average advanced 81.82 points, or 0.18%, to close at 46,397.89 -- a fresh closing high.